About Documents

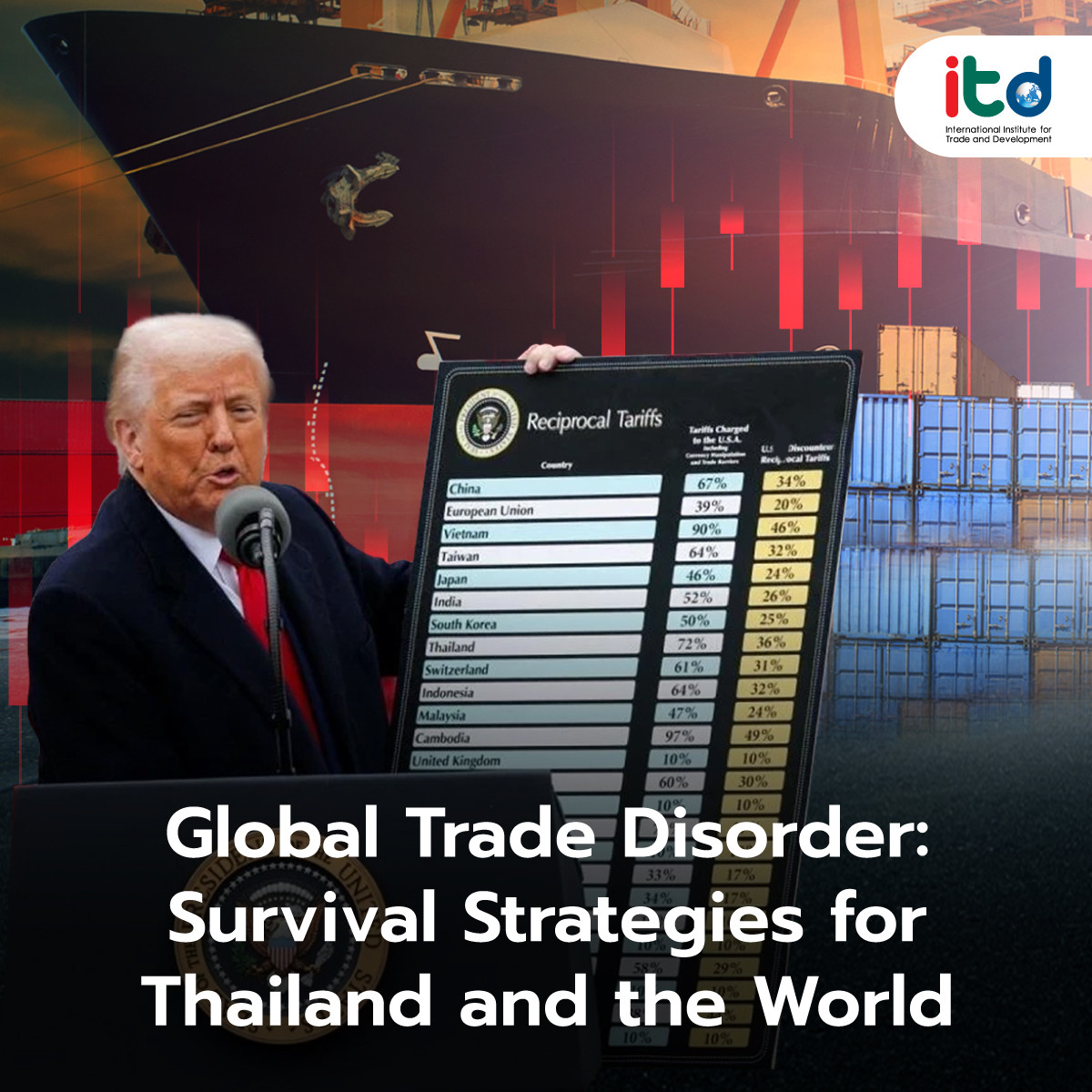

The global trade situation over the past week clearly reflects a state of “Global Trade Disorder.” International political economy has traditionally been characterized by “Multipolarity,” but the United States, under President Donald Trump, seeks to reclaim its “Unipolarity” status through unilateral tariff impositions on various countries worldwide.

As of April 2, 2025, countries have responded with various measures. The World Trade Organization (WTO), whose primary role is to serve as a platform for trade negotiations to reduce trade barriers and promote trade liberalization, and which includes mechanisms for resolving trade disputes among member countries to prevent trade wars, has limited power and influence. It can only dissuade member countries from engaging in trade wars and consistently warn that such wars will have a significant negative impact on the global economy. This situation underscores the need for countries worldwide, especially developing nations that rely on exports as a significant source of national income, to become more “self-reliant” amidst a global trade war that has re-erupted during President Trump’s second term.

While some countries, like China, attempt to use the Multilateral Trading System to counter U.S. tariff increases by filing a lawsuit with the WTO, arguing that U.S. tariffs violate WTO regulations, and seek to demonstrate that China adheres to the Global Trade Order, in contrast to the U.S., which is undermining it, China recognizes that all countries must be self-reliant amidst a disordered global trade environment. Therefore, China imposed retaliatory tariffs of 34% on the U.S. on April 4, 2025, and increased them to 84% on April 10, 2025, alongside other measures, while also utilizing multilateral mechanisms such as controlling exports of certain goods to the U.S. and imposing sanctions on several U.S. companies, signaling that China is not deterred by U.S. tariffs.

Meanwhile, a key U.S. ally, the European Union (EU), employs a mixed strategy to address Reciprocal Tariffs, including condemning them, imposing retaliatory tariffs of 25% on both agricultural and industrial products targeting key voter bases of President Trump, and using multilateral mechanisms like filing a lawsuit with the WTO, similar to China. However, the EU also engages in negotiations, offering to reduce import tariffs to 0% in exchange for the U.S. reducing tariffs on the EU to 0% on April 7, 2025. The U.S. rejected this offer, arguing that it was insufficient to address the entire trade deficit with the EU, and demanded that the EU import energy from the U.S. worth $350 billion to eliminate the trade deficit. This U.S. response indicates that the U.S. has specific demands from each country, including $350 billion in energy imports from the EU and the reduction of Non-tariff Barriers (NTBs).

The U.S. response to Vietnam, a neighboring country of Thailand, is also noteworthy. Despite Vietnam offering to reduce import tariffs to 0% in exchange for U.S. tariff reductions, similar to the EU, on April 4, 2025, the offer was rejected. Peter Navarro, a key advisor on trade and manufacturing to President Trump and a hardliner on trade with China, dismissed Vietnam’s offer, stating that it was unsatisfactory. The U.S. demands from Vietnam include reducing NTBs, as highlighted in the 2025 National Trade Estimate Report by the Office of the United States Trade Representative (USTR). Mr. Navarro also insinuated that China uses Vietnam as a transit point for exports and intellectual property theft.

Impacts and Opportunities for Thailand Amidst Global Trade Disorder

The reduction of Reciprocal Tariffs on Thailand by the U.S. from 72% to 37% and 36%, and recently to just 10% on April 10, 2025, equivalent to most countries except China (145%) and Canada and Mexico (25%, unless they comply with the Canada–United States–Mexico Agreement – CUSMA), will directly affect the export of several Thai products to the U.S., reducing their price competitiveness compared to competitors with lower tariffs. Conversely, Thailand’s price competitiveness will increase compared to competitors with higher tariffs. Based on statistical analysis from the International Trade Centre’s (ITC) Trade Map, the top three Thai products most reliant on the U.S. market will experience the following impacts and opportunities:

- Telephones and wireless devices (HS code 8517): Thailand’s top export to the U.S., accounting for 12% of its global exports and holding the 5th largest market share in the U.S., will gain a competitive edge over China (1st largest market share) with its 145% Reciprocal Tariff, but will face reduced price competitiveness compared to Mexico (3rd largest market share) with its 25% Reciprocal Tariff.

- Computers and components (HS code 8471): Thailand’s second-largest export to the U.S., accounting for 11% of its global exports and holding the 5th largest market share in the U.S., will become more competitive against Mexico (1st largest market share) with its 25% tariff and China (2nd largest market share) with its 145% tariff.

- Tires (HS code 8471): Thailand’s third-largest export to the U.S., accounting for 6% of its global exports and holding the largest market share in the U.S., will become more competitive against Mexico (2nd largest market share) and Canada (3rd largest market share), both with 25% tariffs. China is not a major competitor in this product category.

In addition to the direct impact on Thai exports to the U.S., which account for over 18% of Thailand’s global exports, there will be several indirect impacts, including a slowdown in global demand due to the trade war, a slowdown in investment, indirect impacts from exporting raw and intermediate materials to Mexico, Canada, and China for further export to the U.S., and an increase in Chinese product dumping in Thailand, which will further intensify competition for Thai products, especially for Small and Medium Enterprises (SMEs).

Strategies for the World and Thailand

- Multilateral and Bilateral Negotiations: While the U.S. has temporarily suspended tariff increases for 90 days and reduced Reciprocal Tariffs to 10% for most countries, the long-term solution to global trade disorder lies in constructive multilateral and bilateral negotiations. Lessons from the EU and Vietnam indicate that the U.S. has specific issues to discuss with Thailand, including tariff reductions and increased imports from the U.S. to reduce the trade deficit, as well as NTBs outlined in the 2025 National Trade Estimate Report. Thailand should prepare thoroughly before engaging in negotiations with the U.S., considering the impacts on all stakeholders, especially regarding imports from the U.S. and adjustments to NTBs, such as import restrictions and licensing requirements, import fees, customs and trade facilitation barriers, technical barriers to trade, sanitary and phytosanitary measures, intellectual property protection, service sector issues, digital trade and E-commerce barriers, investment barriers, labor issues, state-owned enterprises, and government procurement. Thailand should also address U.S. claims about the Bank of Thailand’s currency manipulation. Close cooperation with the American Chamber of Commerce in Thailand (AMCHAM) is crucial for smooth preparation and negotiations.

- Seeking Potential Alternative Markets: Thailand should diversify its markets to reduce reliance on any single market, particularly the U.S., which pursues unilateral trade policies. Potential alternative markets include Middle Power countries like Australia, India, South Korea, Turkey, and South Africa, which collectively account for over 12% of Thailand’s global exports. Thailand should also accelerate Free Trade Agreement (FTA) negotiations with the EU, leverage ASEAN as a base for cooperation with the EU, and expand markets in other developing countries. Additionally, Thailand should expedite market access to Saudi Arabia, with which it recently restored diplomatic relations, and the Gulf Cooperation Council (GCC) countries, which have high purchasing power and diverse product demands, especially for halal products.

- Promoting Regional Production and Trade: ASEAN is a crucial component of navigating the current trade war. However, collective ASEAN negotiations with the U.S. may be ineffective due to President Trump’s preference for bilateral talks. Building a robust and sustainable supply chain through increased trade and investment within ASEAN is a more viable solution to mitigate the trade war’s impact and enhance long-term economic security. ASEAN, with its population of over 650 million, rapidly growing economy, and diverse resources and industries, offers significant potential. Addressing challenges such as aligning with varying standards and regulations and modernizing infrastructure requires close collaboration among ASEAN members. This cooperation will strengthen the region’s economic resilience and sustainability.

The world faces numerous crises, including climate change, wars, pandemics, natural disasters, technological disruptions, demographic changes, and uneven economic growth. Addressing these crises requires global cooperation rather than competition, which risks confrontation and exacerbates existing global challenges. Amidst the turbulent global trade environment, Thailand and other nations must pursue dialogue and genuine cooperation. Discussions based on mutual benefits, understanding, and respect at both bilateral and multilateral levels are essential for effective and creative problem-solving and for establishing a fair and sustainable trading system for all. Strengthening and reforming the WTO to ensure inclusiveness and mutual benefit, a topic long under discussion, is also critical to ushering in a new era of barrier-free and opportunity-filled trade for all sectors of global society.